Author: Soorya G

Arab investors are closely observing the evolving scenario of the soccer sector in Brazil, which is undergoing a transformational organizational revolution with significant implications for the sport and its commercial aspects.

Recently, Mubadala Capital, from the United Arab Emirates, signed a partnership with a Brazilian soccer league made up of 15 renowned clubs, including fan favorites such as Flamengo, Corinthians and São Paulo. This agreement, scheduled to begin in 2025, will allow these clubs to collectively negotiate their TV and commercial rights for the Brazilian championship. Mubadala’s involvement as a consultant opens the door to possible investments and shareholdings in these rights.

These multi-million dollar deals should inject substantial capital into the soccer sector, facilitating the development of infrastructure and the training of talent. In addition, the transformation promises a more professional approach to management, marketing and business opportunities, generating positive changes in the Brazilian soccer scene.

This evolution is further boosted by the SAF law of 2021, which allows Brazilian soccer clubs, historically non-profit entities, to become companies with the support of private investors. The SAF law has been revolutionary, attracting the interest of investors looking to capitalize on the untapped potential of Brazil’s soccer market.

Arab investors, such as Mubadala, see the current scenario as a fantastic opportunity to invest, with around 50 clubs potentially ready for partial or total takeovers in the coming years.

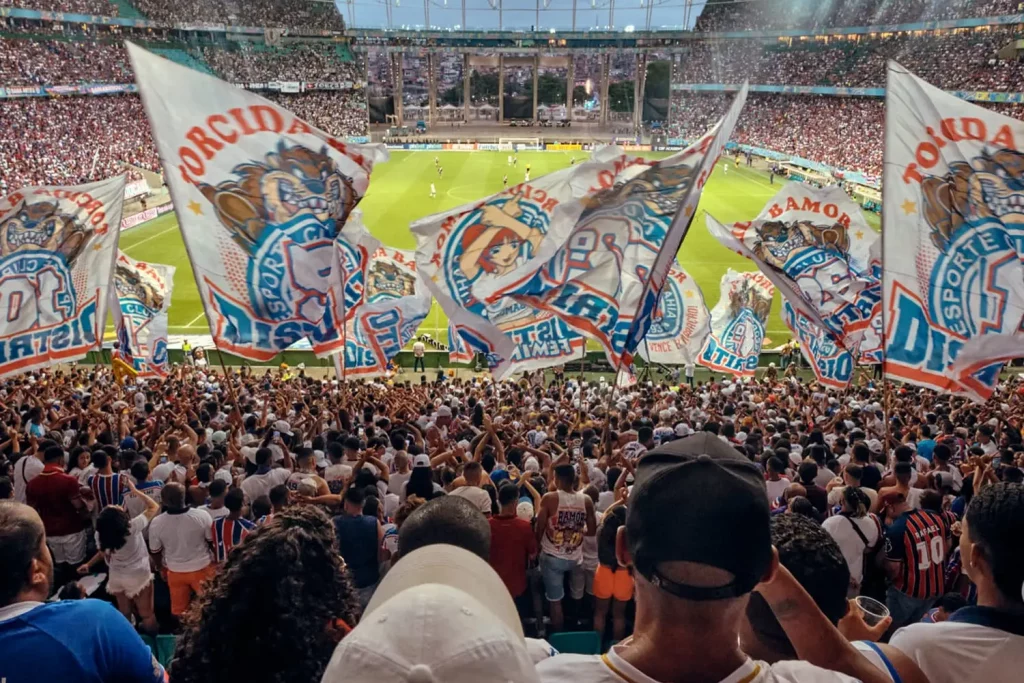

The Brazilian soccer sector has seen some remarkable deals, with City Football Group, owned by Abu Dhabi United Group, acquiring 90% of Bahia, a club founded 92 years ago in Salvador. These strategic investments in countries like Brazil, a traditional exporter of athletes, guarantee a constant supply of talented players for Arab nations, contributing to the growth and sustainability of soccer in the region. In the near future, as the sector witnesses initial public offerings from soccer clubs, this will attract more investment and open doors for new international players in the Brazilian market.

Although Brazil remains the main target for investors, neighboring countries such as Chile, Uruguay and Mexico, with similar legislative changes allowing clubs to become companies, are also attracting potential partners.

In conclusion, the representative relationship between Arab investors and Brazil’s soccer sector is promising for mutual growth, economic ventures and the evolution of the sport in the region and beyond.